401(K) Retirement Plan

Enrollment Information

Eligible new hires will be automatically enrolled at 6 percent pre-tax and have their funds invested in the T. Rowe Price account that most closely matches your normal retirement date. If you wish to enroll at a different percentage, invest in other funds or waive participation altogether, you must contact Principal Financial Group at 800-547-7754 (refer to group 381756) before your effective date.

Caution! Unregistered financial accounts are tempting targets for hackers. To make your 401(k) account more secure, be sure to register at www.principal.com and set up multi-factor authentication. See the registration instructions below.

Ruan 401(k) Plan Overview Video (5 minutes)

Reference group/contract number 381756.

Once enrolled, you'll have access 24/7 to check your account balance, modify your payroll contribution, update your beneficiaries, change investment options and more through www.principal.com, by calling Principal toll-free at 1-800-547-7754, or by downloading the mobile app.

A listing of the various investment fund options available under the Ruan 401(k) Savings plan.

Basic plan information about the Ruan 401(k) along with a list of potential fees that may apply to your account.

Matching Contributions

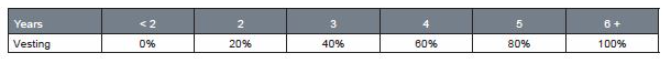

After 1 year of service Ruan will match 50% of the first 6% you contribute (maximum 3% of pay). You are always 100% vested in the contributions you choose to defer. Company matches are rested based on year of service.

Additional Resources

Principal Website Demo (10 minutes)

Pre-Tax vs Roth Contributions Video

Want more? Each month Principal Financial offers a free 30 minute web presentation on financial topics that matter to you and your retirement. Review and register for upcoming webinars at www.principal.com/learnnow. Can't attend on that date/time? Register anyway! After the event you'll received an e-mail with a link to the recorded presentation for you to play back at a more convenient time.

Questions?

Call the Human Resources Hotline at 1-800-845-6675 option 4.